Renters Insurance in and around Franklin

Get renters insurance in Franklin

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Franklin

- Brentwood

- Nashville

- Thompson's Station

- College Grove

- Columbia

- Spring Hill

- Murfreesboro

- Dickson

- Fairview

Protecting What You Own In Your Rental Home

Your things are important; keeping them secure should be just as important. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can cover your possessions, from your clothing to your lamp. Unsure how to choose a level of coverage? That's okay! Christopher Hodges is here to help you identify coverage needs and help pick the appropriate policy today.

Get renters insurance in Franklin

Renting a home? Insure what you own.

There's No Place Like Home

When renting makes the most sense for you, State Farm can help protect what you do own. State Farm agent Christopher Hodges can help you build a policy for when the unpredictable, like a water leak or an accident, affects your personal belongings.

There's no better time than the present! Reach out to Christopher Hodges's office today to discover the benefits of a State Farm renters policy.

Have More Questions About Renters Insurance?

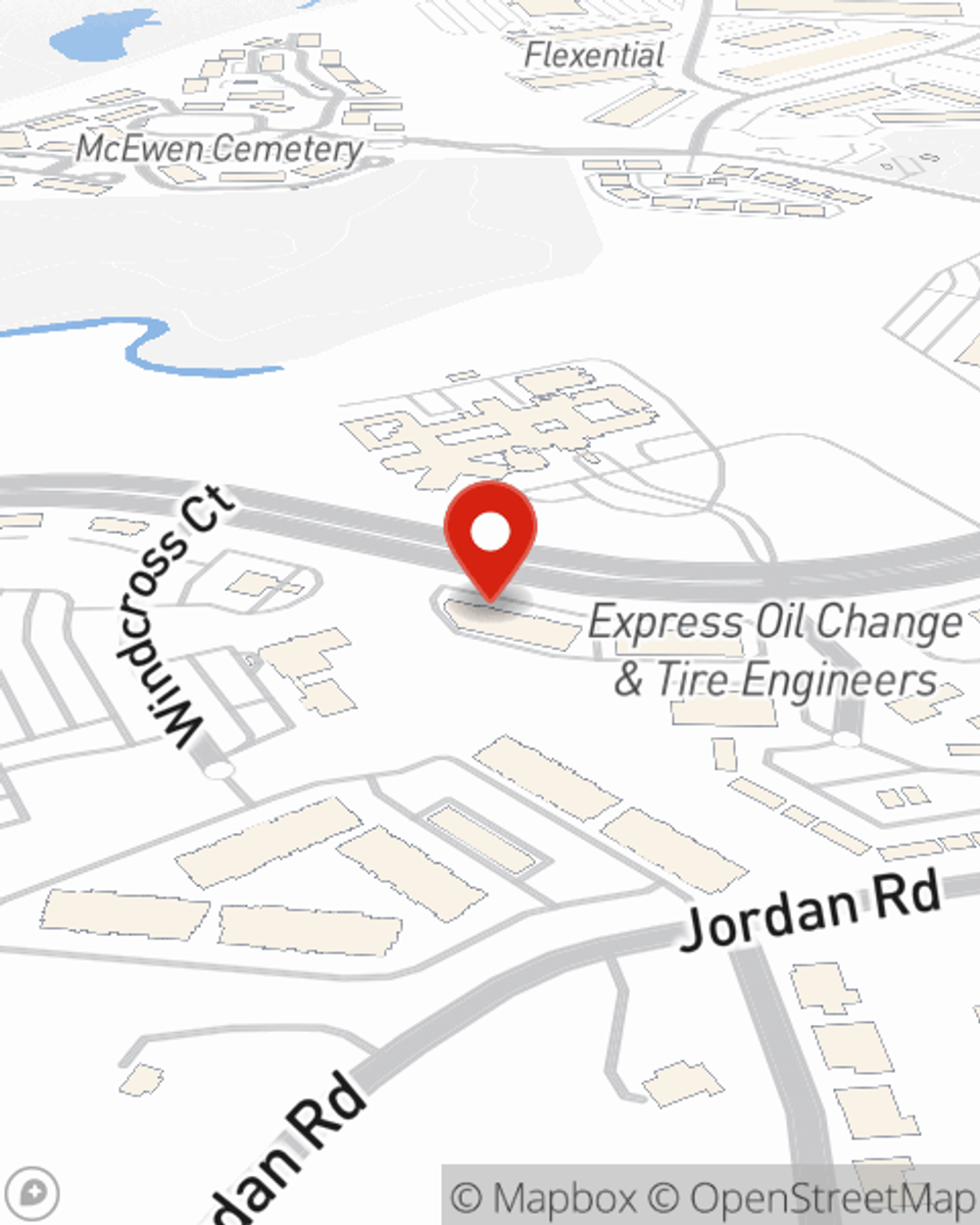

Call Christopher at (615) 656-4395 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Christopher Hodges

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.